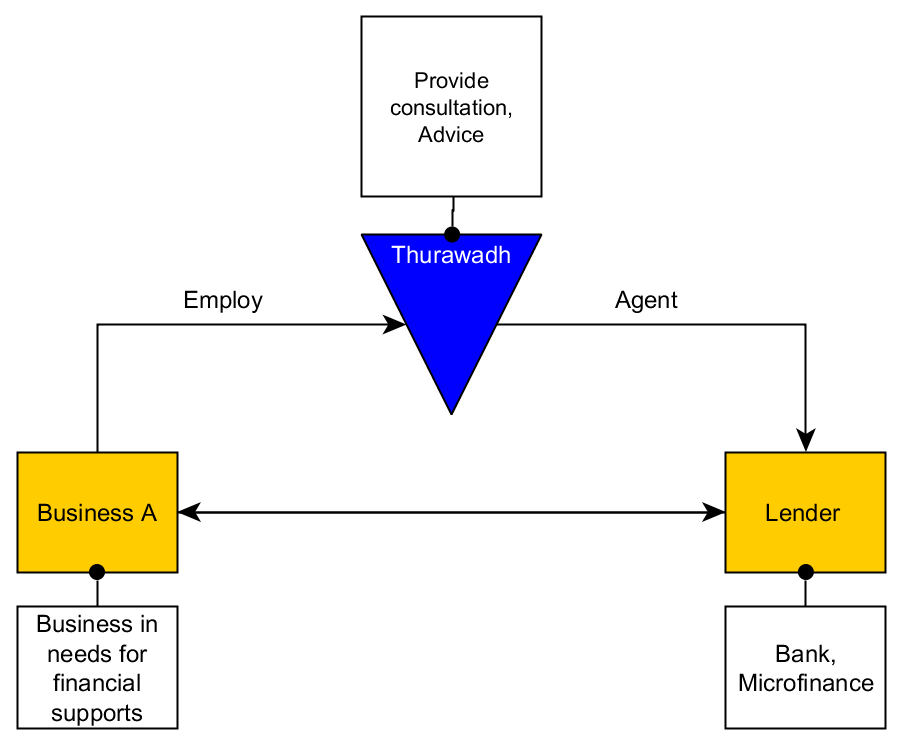

Thurawadh work as a mediator to assist the parties to negotiate a settlement or find resolution. We connect business to business (B2B), business to talents (B2T), business to lenders (B2L) to enlarge cooperation and scale up business within regionalization and globalization era.

Our customer employs Thurawadh to act on their behalf to negotiate a matter between two parties, and who for that reason is considered as the agent of both.

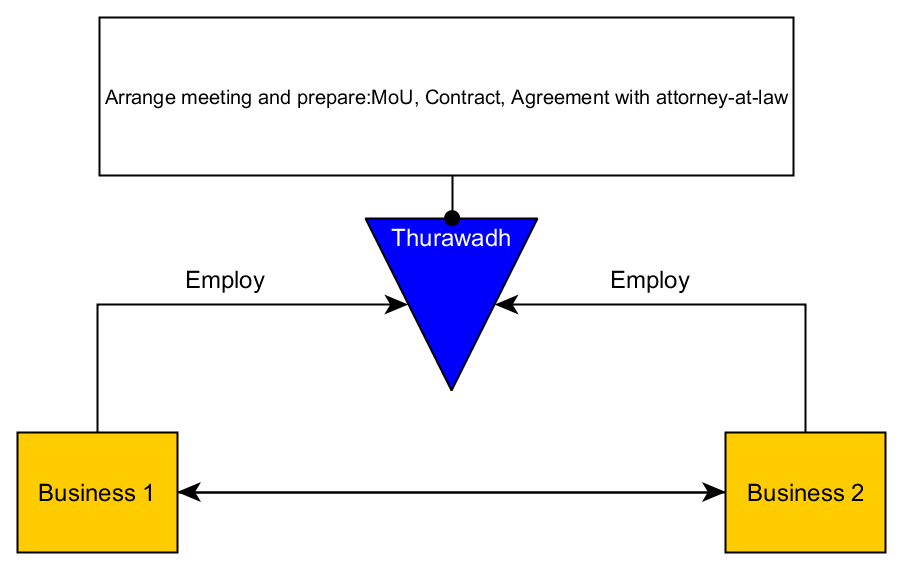

Through Thurawadh, project owner and investor can meet each other face to face. With attorney-at-law and our legal team will assist the two parties to make the deal. MoU, contract or agreement will be made upon necessity in which complies with the Cambodian law.

2. What make us different from microfinance?

Microfinance refers to an array of financial services, including loans, savings, and insurance. Microfinance collects deposit from a customer and provides loans or lending to another customer with particular interest rate.

Thurawadh, we collect idea and business plan from project owner and help promote their business concept to investors. We connect the project owner to investor and vice versa. We only match business to business, business to lender, and business to talent. However, we do not collect deposit money from investor and provide loans to the project owner.

3. What make us different from crowdfunding platform?

In crowdfunding, project or enterprise obtains financial contributions from a large number of investors who find out about the projects on Internet platforms.

According to the consultation started by the European Commission, crowdfunding is defined as follows:

“Typically on the two sides of a crowdfunding transaction there is a person with an idea for a project who sets up a crowdfunding campaign on one side (project owner or campaigner), and many people who give money to realise this idea on the other side (contributors).

The campaigner can collect funds directly, but often a web-based intermediary (so-called ‘crowdfunding platform’) will assist in publishing campaigns, reaching contributors and collecting funds. These platforms usually perform certain screening and monitoring functions as well, and they typically charge a fee for these services."

Different from crowdfunding platform, Thurawadh works as an intermediary between project owner and investor. Similarly, the project owner can submit their project information or business plan online. Investor can find out information of project online.

However, crowdfunding platform allow financial transaction on their platform without any witness from lawyer. Project owner or campaigner can collect money from investor directly through online payment system such as visa card, PayPal, etc.

Whilst, Thurawadh do not make any online transactions. Project owner and investor can meet face to face. Upon agreement from both parties on funding option, Thurawadh will assist in legal service to secure the transaction such as agreement, shareholder agreement, or MoU.

How to secure your business idea/plan? How to secure your investment? Thurawadh can help securing your business idea/plan, and securing your investment.

4. How do we charge our service fee?

Thurawadh charges only our professional fee for our services based on needs of customer. It includes preparing agreement, MoU, shareholder agreement, etc.

For fundraising, we charge on success fee of the total fundraising target. Investor will work and make transaction directly with project owner. So that both investor and project owner can avoid double transaction costs if they use different bank.